Landscape of Change:The Numbers Behind Population And Migration In Malta’s Towns

By Sabrina Zammit, Julian Bonnici, and Daiva Repečkaitė

Photo cover: Joanna Demarco

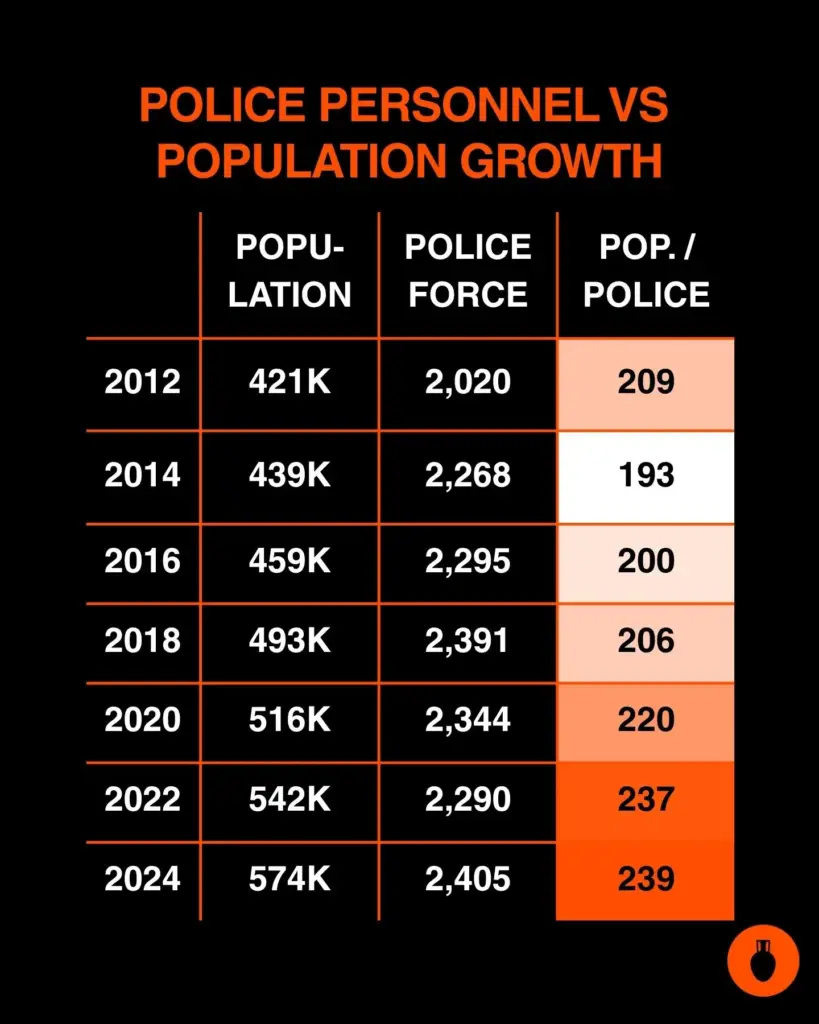

Over the past decade, Malta has undergone rapid demographic and economic shifts, primarily driven by migration and labour market demand.

A cross-border investigation by Amphora Media, in partnership with Spain’s Público, examines fifteen localities across Malta and Gozo – grouped into six clusters – to trace how population growth is reshaping communities.

The findings show that tensions often stem less from migration itself or the tax revenue migrants generate, and more from inadequate government investment in public services, which affects both citizens and foreigners.

The clusters are based on geographical proximity. An EU-funded case study of Malta found that migrants prioritise proximity to their workplace when choosing where to live, followed by strong transport links.

Malta is divided into six districts, which now have regional administrations. Migrant populations are spread unevenly among them. According to the 2021 census, migrants from the EU, non-EU European countries (including the UK) and others were distributed unevenly.

In proportion:

- Northern Harbour, which includes Gzira, Qormi, Hamrun, Sliema and St Julian’s, had the highest share of EU citizens.

- In Gozo, two in five immigrants come from European non-EU countries, such as the UK and Serbia.

- In the Southern Harbour district, which includes Marsa, Fgura and the Three Cities, nearly two-thirds of the foreign population are non-European or stateless.

What follows is a statistical breakdown of each locality

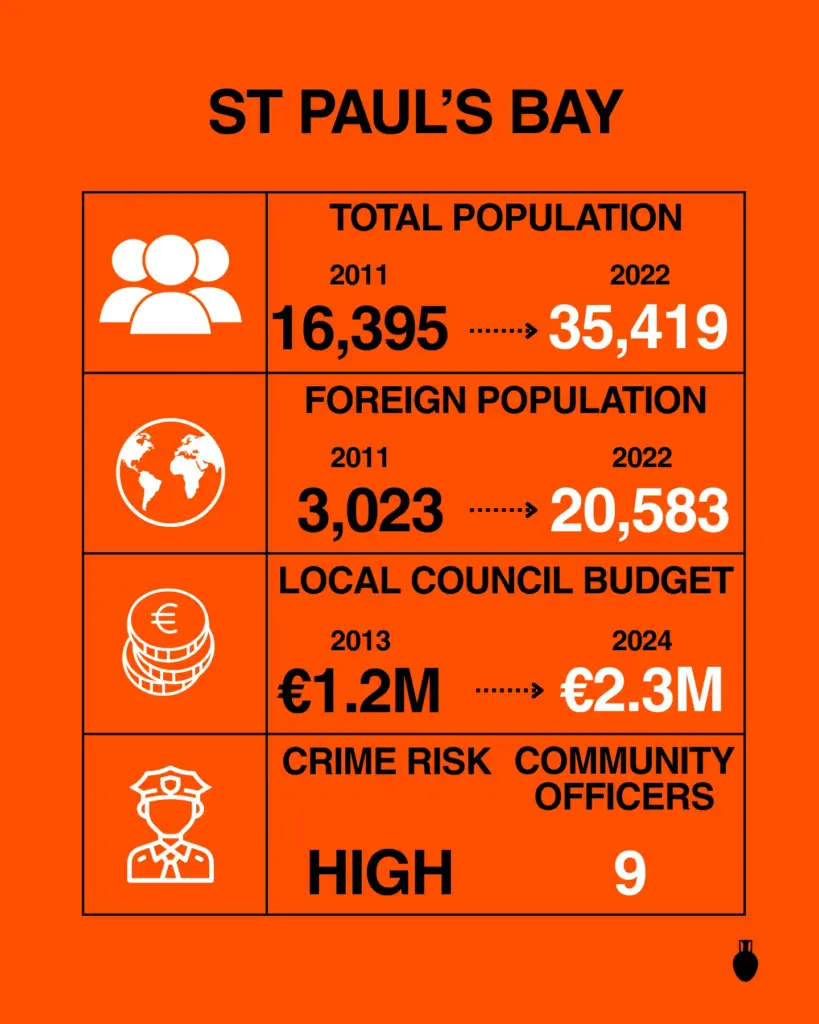

Cluster 1: St Paul’s Bay

St Paul’s Bay

St Paul’s Bay has been shaped by rapid population growth and migration. By 2022, it was home to more than 35,000 people, nearly 60% of them foreign nationals—up sharply from less than one in five a decade earlier.

This shift has also brought greater religious diversity, with Orthodox Christianity, Islam and Hinduism now established alongside the dominant Roman Catholic faith.

Many dwellings remain vacant or used seasonally, limiting supply of primary residences. 37.3% (8,848) were either vacant or used seasonally according to data from 2021.

Despite the pressures, St Paul’s Bay remains relatively well served, with 19 bus routes.

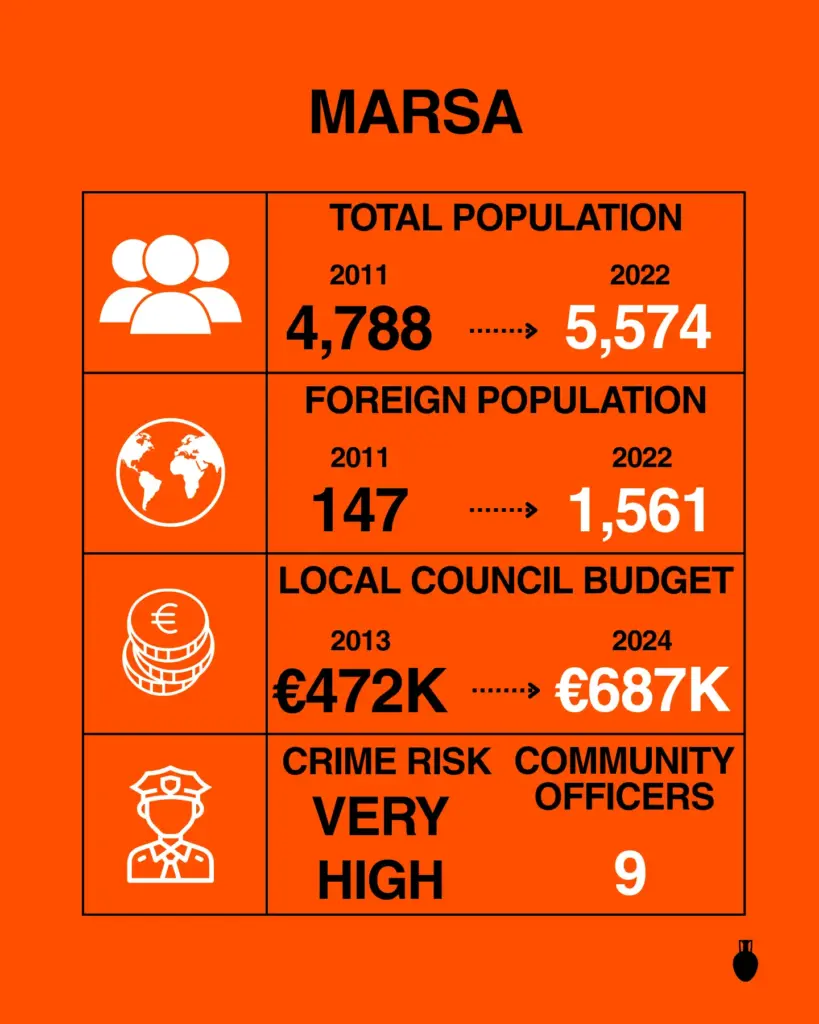

Cluster 2: Marsa, Ħamrun, Qormi and Pietà

Marsa

Ħamrun

Qormi

The second cluster comprises Marsa, Ħamrun, Qormi, and Pietà, which together had a population of 41,689 in 2022. Foreign residents numbered 10,630, representing around 25.5% of the population, a significant increase from just 2.3% in 2011.

Marsa is notable for having hosted Malta’s first large reception centre for asylum seekers, in operation from 2002 until April 2024, when its last residents were transferred to Ħal Far. Data suggests that many former residents settled in nearby areas where housing was more affordable.

Security concerns persist in this cluster. Police reports in both 2017 and 2024 classified Marsa and Ħamrun as high-risk localities. In 2021, theft and property damage were the most frequently reported crimes in Marsa, followed by drug-related offences.

Cluster 3: Sliema and St Julian’s

Sliema

St Julian’s

In 2011, foreigners accounted for 15% of the combined population of Sliema and St. Julian’s. By 2022, the figure had surged to 52%, underscoring the towns’ pivotal role at the heart of Malta’s international community.

The area’s employment base is closely tied to the iGaming sector, classified under information and communication, where the average basic salary reached €2,159 in 2022.

Tourism brochures advertise Sliema and St. Julian’s as coastal resorts offering a wide range of accommodation options, conveniently close to the action. In particular, Paceville is Malta’s premier entertainment hub, with a diverse range of nightclubs and restaurants.

Cluster 4: Msida and Gżira

Msida

Gżira

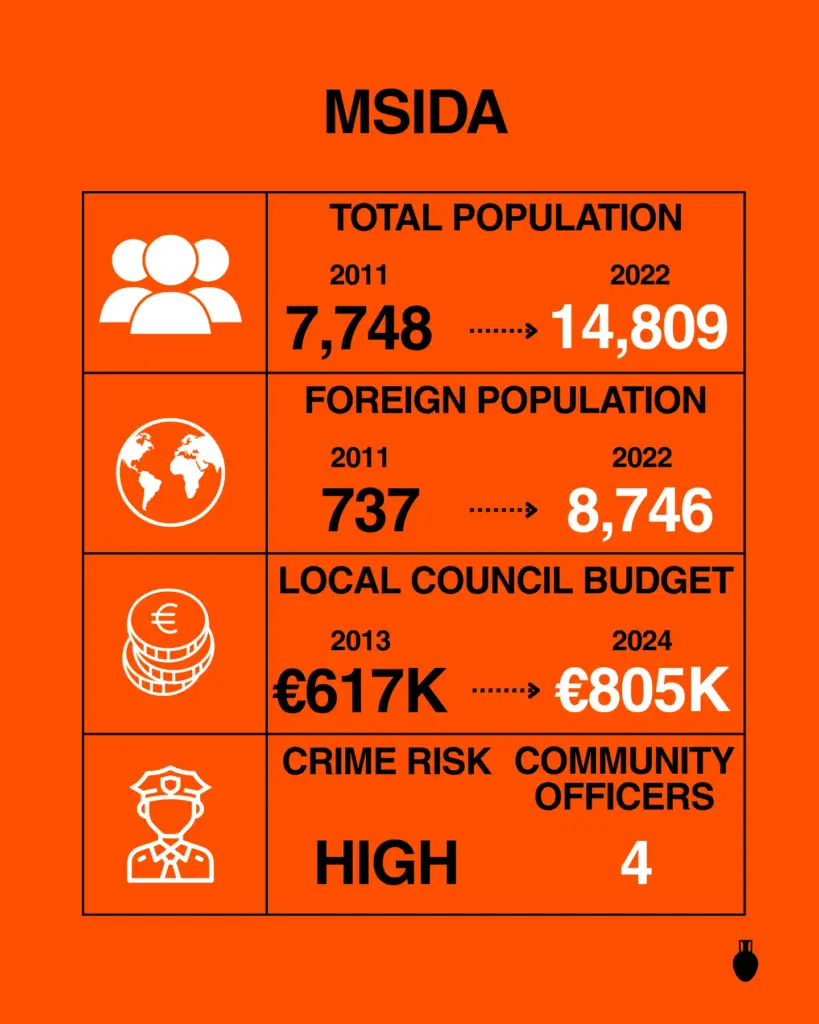

By 2022, Msida and Gżira had a combined population of 26,398, with foreign nationals making up 58.4%. In 2011, the share was 10%, a transformation that illustrates one of the steepest demographic shifts in Malta.

Msida is home to the University of Malta and Mater Dei Hospital, two of the country’s most prominent institutions.

The locality has long been a traffic bottleneck with congestion around the Marina and Msida Creek impacting air quality, noise levels, and overall accessibility. Works for a new flyover under the Msida Creek Project aim to ease this burden, but the locality remains defined by its role as a transit hub.

Gżira on the other hand has become increasingly commercial, with “restaurants opening all the time” and Mayor Neville Chetcuti warning that more policing is needed to cope with rising pressures.

Foreign residents now make up about 60% of the community, a shift that the Mayor described as “obviously, we have the problems that come with that”.

Housing demand from hotels, Airbnb, and new apartment blocks has also driven up rents to the point where several people now share apartments to afford them.

Cluster 5: Żebbuġ, Victoria and Munxar (Gozo)

Żebbuġ (Includes Marsalforn)

Victoria (Rabat)

Munxar (Includes Xlendi)

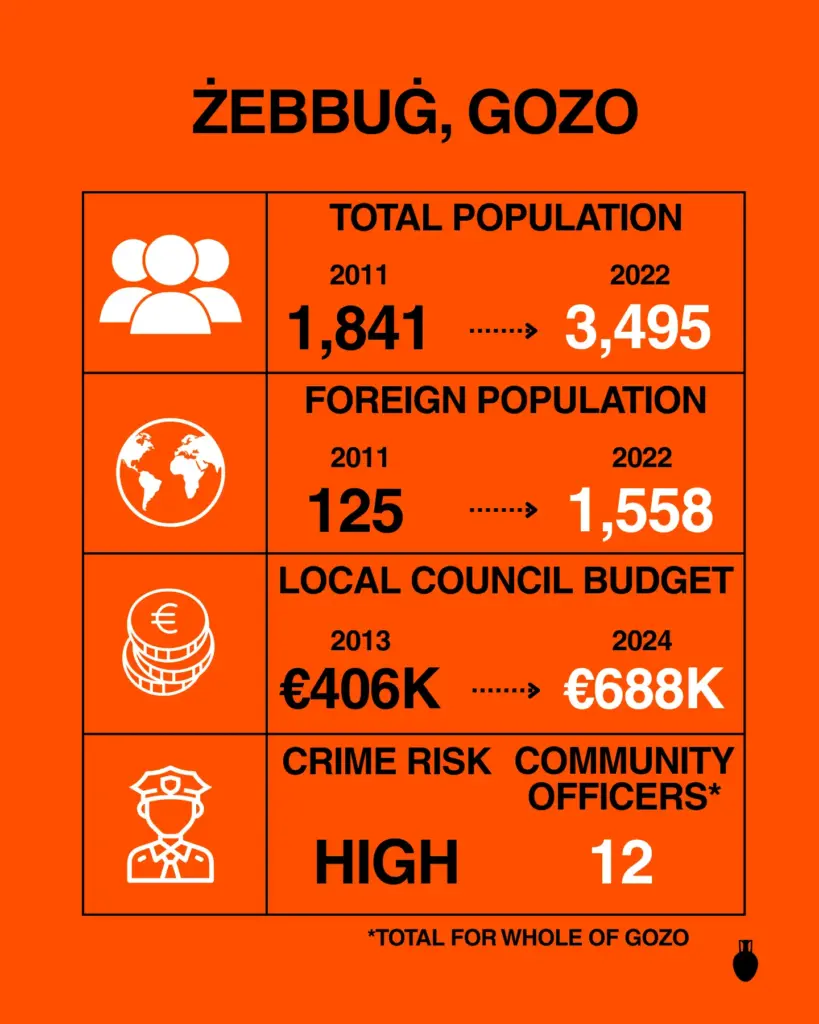

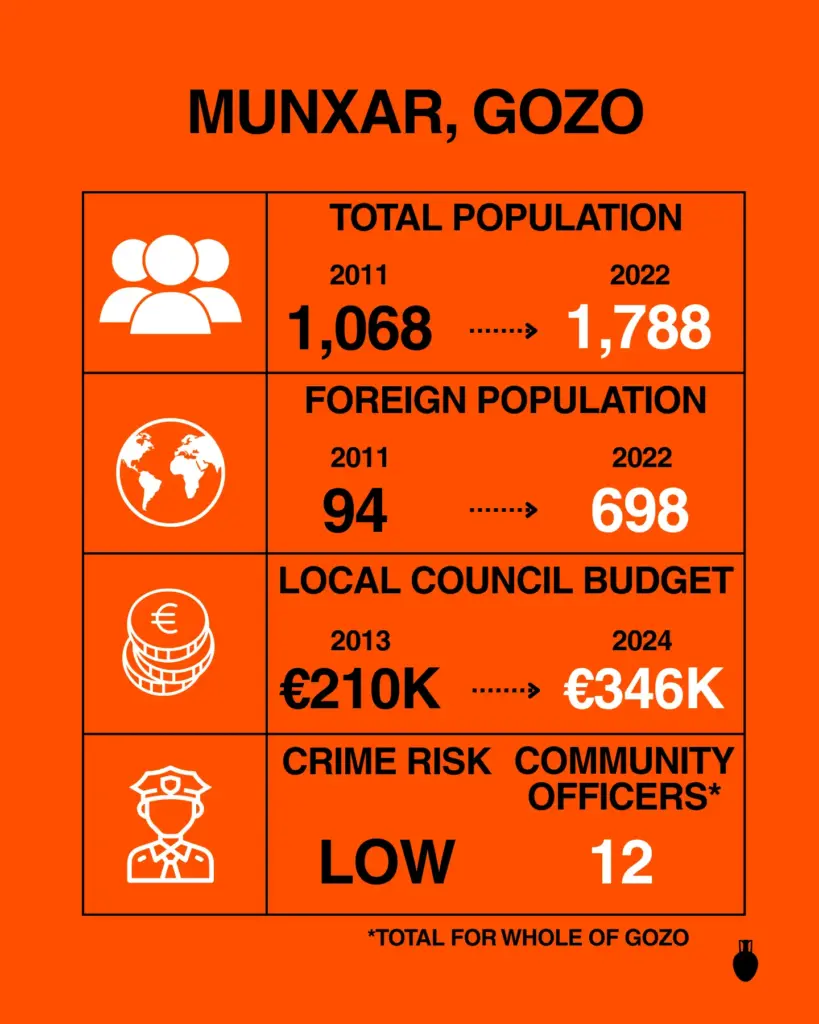

Cluster 5 comprises the three Gozitan localities with the highest share of foreign residents: Żebbuġ, Victoria, and Munxar.

In 2022, their combined population was 12,647, with foreigners accounting for around 30%. Back in 2011, the figure was just 3%, a dramatic shift over little more than a decade.

Victoria, the island’s capital, serves as Gozo’s commercial and administrative hub. It concentrates the largest share of businesses and services, drawing both locals and newcomers.

Żebbuġ and Munxar, which include the popular seaside villages of Marsalforn and Xlendi, have become well-known rental hotspots among foreigners.

Rental affordability plays a role. The median monthly rent for a two-bedroom apartment in these localities hovers just above €600, significantly lower than in comparable areas on Malta’s mainland.

The Żebbuġ mayor, Baskal Saliba, noted that the difference lies in availability as much as price: “In Marsalforn, rent is a bit cheaper and you have many more availabilities… you find many more rental opportunities there compared to Żebbuġ or other villages.”

Cluster 6: Marsaskala and Birżebbuġa

Marsaskala

Birżebbuġa

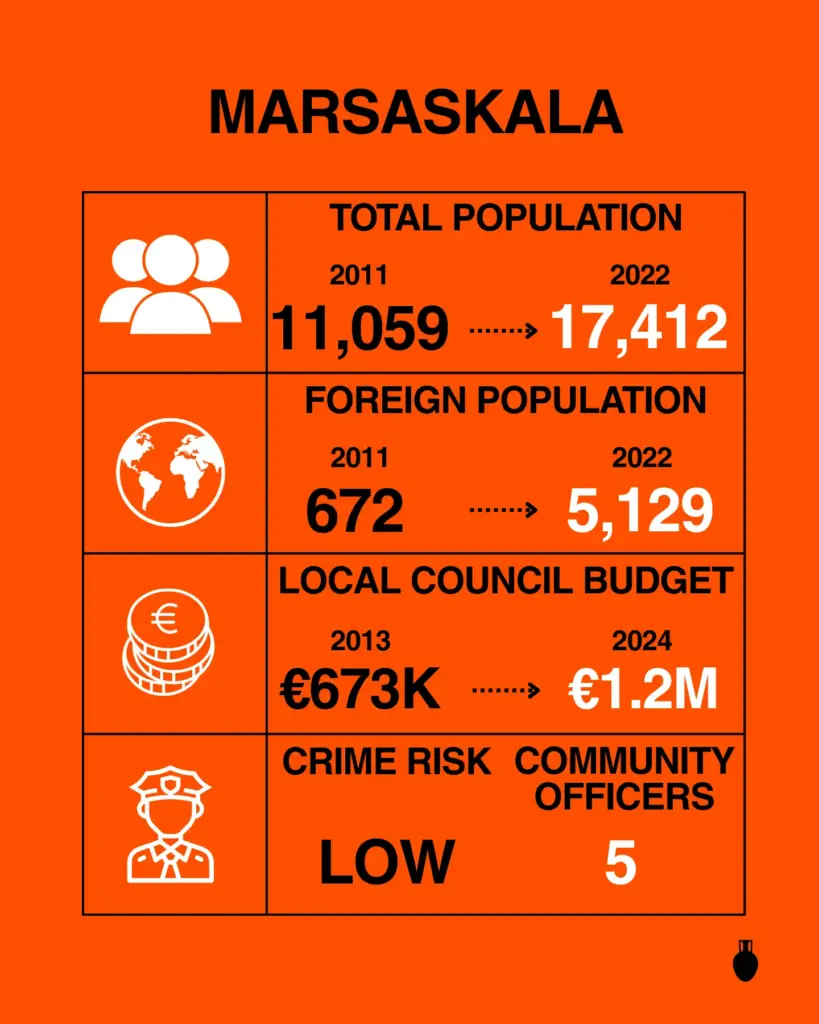

The final cluster covers Marsaskala and Birżebbuġa. In 2022, their combined population stood at 29,401, with foreign nationals making up 29.5%. Back in 2011, foreigners accounted for just 12% underscoring how rapidly these southern localities have changed.

Housing tells a different story in each town: Birżebbuġa remains one of the more affordable seaside options, with two-bedroom rents just over €600, while in Marsaskala prices climb above €800.

Marsaskala’s Mayor Mario Calleja said local schools now reflect “around 40 different languages,” and the council has leaned into integration, installing a monument to diversity and running community activities. He said, “The most important thing is that we don’t discriminate.”

When it comes to safety, the two towns differ as well. Marsaskala is considered a relatively low-risk area and has recently opened a new police station, whereas Birżebbuġa was flagged as high risk in 2024.

This investigation was developed with the support of Journalismfund Europe.